The following breakout is a summary of GSUSA’s financials during FY2023, and this data comes from two sets of reports:

Before delving into the data, you may want to read through this article called How to Navigate Council Finances if you aren’t already familiar with nonprofit financial documents and reports. Even though it’s specific to councils, it explains what some of the following information provides, what it means, and its context.

“FY2023” covers the period between 10/1/2022 and 9/30/2023.

Note that this is NOT an in-depth review of finances, and conclusions should not be based on this very brief snapshot. For a more complete picture, one should look through all balance sheets and review them over a number of years.

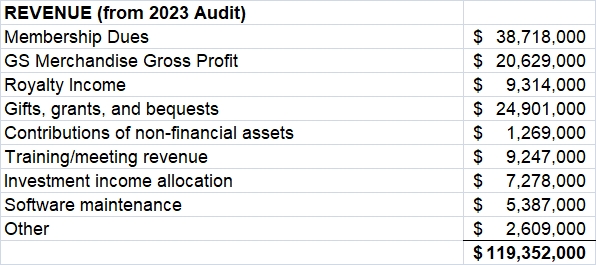

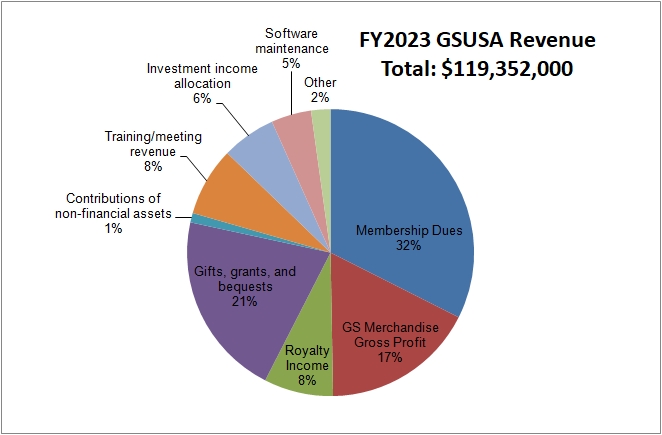

REVENUE

These figures come from the FY2023 audit (pg. 7):

Software maintenance comprises payments from councils for the use of GSUSA’s IT platform.

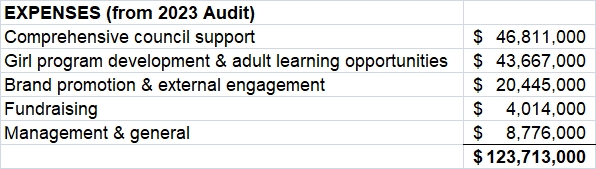

EXPENSES

Expenses for FY2023 were as follows in these major categories (also found on pg. 7 of the audit):

Expense category definitions for can be found on pg. 10-14 of the audit. Many things can fall under “Comprehensive council support” and “Girl program development and adult learning opportunities” including:

- Salaries and related benefits

- Travel and related expense

- Nonstaff services

- Professional services

- Rent, occupancy and depreciation

- Office, publishing and technology

- Grants and scholarships

- Other expenses

A breakout of these specifics can be found on pg. 8 of the audit and on page 13 of the 990.

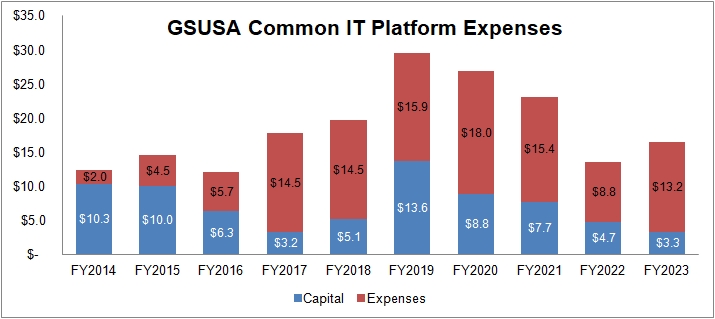

GSUSA is in the process of building and maintaining a nationwide IT platform that all councils are required to use as a part of their charter criteria. The IT platform comprises a number of components such as Volunteer Toolkit, gsLearn, myGS, and Digital Cookie, just to name a few. The 2023 Stewardship Report was held before the end of the 2023 fiscal year, so FY2023 amounts are projected. During FY2023, projected expenses for the IT platform cost $16,500,000 ($3.3 mil capital & $13.2 mil expenses). Since FY2014, when the project first started, a total of $185.5 million has been spent on this IT platform.

The Consolidated Statements of Financial Position (listing of assets & liabilities) is found on pg. 6 of the audit.

NOTES OF INTEREST

* For the third year in a row, there was a large intake of gifts, grants, and bequests although the amount was down from the previous year. In FY2022, $28,557,000 was recorded while in FY2023, $24,901,000 was received.

* A total of $1,555,496 was spent on legal services which is up slightly from $1,544,863 in FY2022 (FY2023 990, pg. 13).

* GSUSA spent $38,879,000 on salaries in FY2023, down from $48,037,000 in FY2022. This is the lowest amount spent on salaries since FY2015.

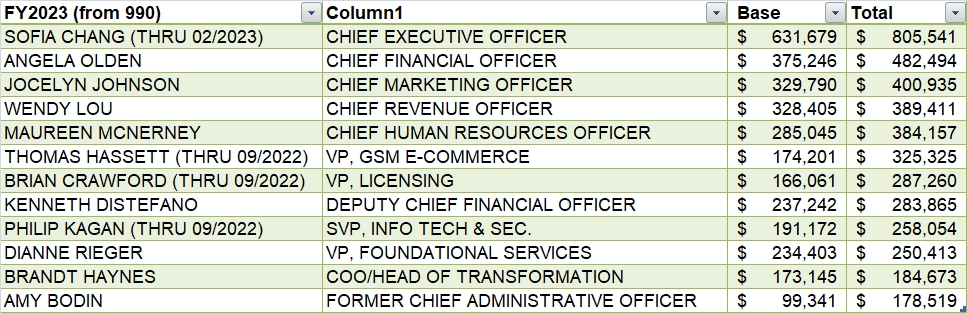

* The top 12 salaries of GSUSA’s Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees were as follows (FY2023 990, pg. 8):

The total column reflects a combination of a base salary, bonus & incentives, retirement & other deferred compensation, and nontaxable benefits.

* Total number of GSUSA staff employed during FY2023: 512 (FY2023 990, pg. 2). This is up from 447 in FY2022.

* Total number of GSUSA staff making over $100,000: 166 (FY2023 990, pg. 9). This is up from 139 in FY2022.

* For the fourth year in a row, GSUSA used its line of credit. A line of credit is a preset borrowing limit that can be tapped into at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. In FY2020, GSUSA borrowed $7 million against its line of credit and took out an additional $17 million in FY2021 for a total of $24 million. In FY2022, the debt was reduced to $8,200,000. As of January 2023, no further loans could be requested or reborrowed against this line of credit, and GSUSA ended the FY2023 year owing $13,000,000. The total amount of interest paid on this line of credit for FY2023 was $786,000. More detail about this topic can be found on pgs. 28 & 29 of the FY2023 Audit.

* GSUSA distributed $7,376,340 to councils in the form of grants (FY2023 990, pg. 13) although $10,500 of that went to The Teton Science School. Specific amounts per council can be found in the FY2023 990 starting on pg. 52.

* Additionally, GSUSA gave $1,207,541 in funds to five scholarship funds, including $1,100,000 to the GS National Gold Award Scholarship Fund. A listing of the scholarship funds can be found on pg. 65 of the FY2023 990.

* For details regarding the pension fund, see the FY2023 audit pgs. 33 – 38.

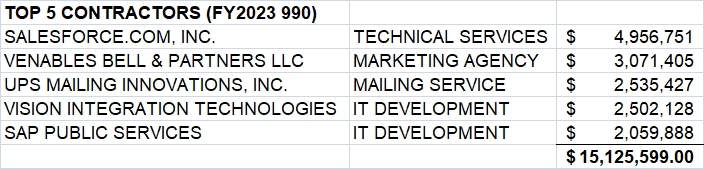

* Top 5 Contractors (FY2023 990, pg. 9):

Independent contractors receiving over $100,000: 84 (FY2023 990, pg. 9). This is up from 78 in FY2022.

Additionally in FY2023, GSUSA spent:

- $2,492,247 on temporary staffing

- $4,005,109 on conference center management

- $4,327,258 on marketing consultants (FY2022: $1,860,289)

- $525,104 on property strategy consulting (FY2022: $1,112,250)

- $1,250,175 on technology (fund development) consulting (FY2022: $971,214)

- $173,137 on an DEI-RJ audit (FY2022: $217,967)

- $90,416 on membership recruitment consulting (FY2022: $300,225)

THROUGH THE YEARS

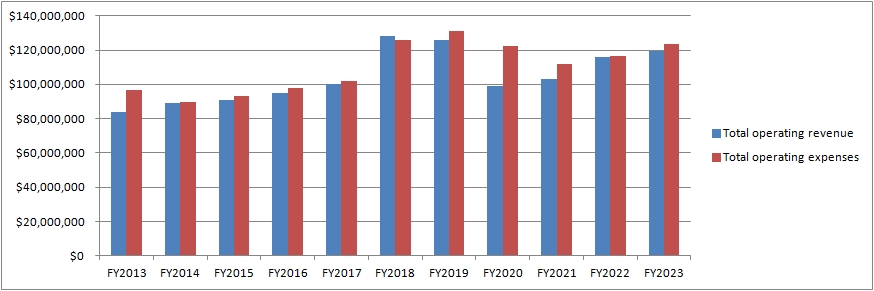

The following figures are from official audits and differ slightly than what is found in the 990s due to accounting differences. Revenue from FY2018 included the $10 raise in membership dues.

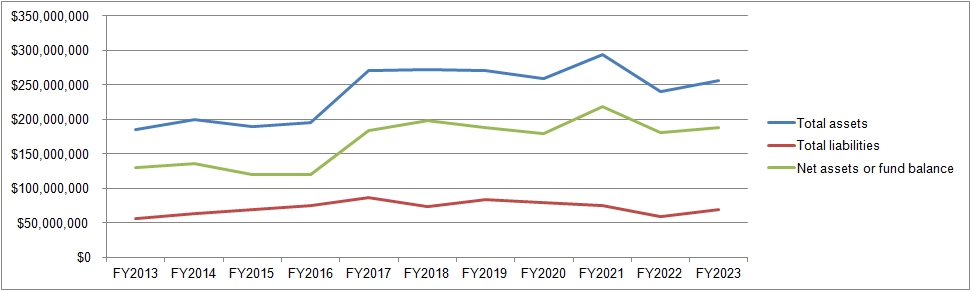

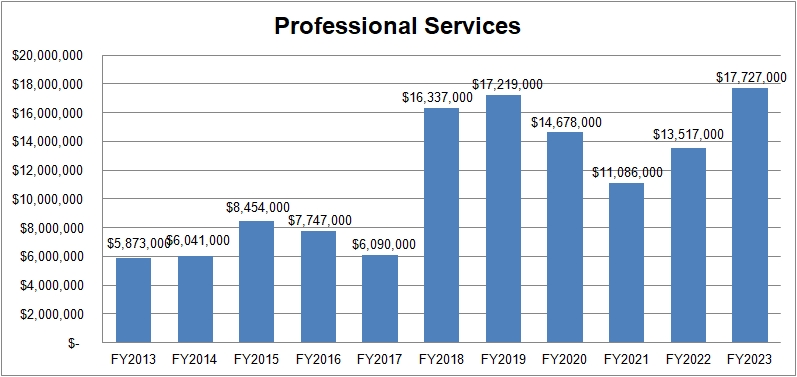

The next chart’s data is pulled from 990s:

Other charts of interest: